PLEASE REMEMBER THIS IS FOR EDUCATIONAL PURPOSES ONLY!

Continued from Part 2

From my last post, several other indicators were added to the mix. These included Bollinger Bands, DMI, RSI, and MACD. The risk to reward tool in Profitsource was also used to confirm a projected target, and establish a possible entry and exit plan based upon the stock price. Finally, an option strategy was chosen, and the risk to reward of the option contract was compared to the risk to reward of the underlying equity. The options risk to reward and volatility view were done using Optionetics Platinum service.

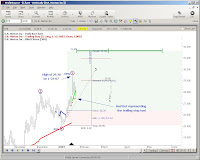

My original entry point was at $0.90 per contract or $90.00. The defined stop was at $0.45 or $45.00, and the point of a half position profit-taking was at $1.85 or $185.00 per contract. That being said, my order was filled at $0.95 per contract.

Looking back at the chart on 01-23-07 you can see that DHI made a considerable move to the upside. DHI had reached a intraday high of $29.38 and the option intraday was as high as $2.60 or $260.00 per contract. Two other things worth noting is the Elliott Wave 5 formation from the high, and the breakthrough of the $29.05 TAPP. Normally, this would be a point at which I exit the trade, but a couple of things prevented this. First, I had set my initial exit for profit-taking higher than the $2.60 of the intraday. Secondly, greed had set-in by the time I saw the contract price reach $2.60, because I still believed DHI had a considerable move to come, so I moved the stop-loss point up to the trailing stop point of around $27.41, and left the profit-taking exit the same. If you haven’t used the trailing stop function in Profitsource, I would suggest you give it a try and see if it works for you. The only gripe I have is that you can’t pick a entry date from a mouse click. This forces you to enter the date in manually. Looking back at the chart on 01-23-07 you can see that DHI made a considerable move to the upside. DHI had reached a intraday high of $29.38 and the option intraday was as high as $2.60 or $260.00 per contract. Two other things worth noting is the Elliott Wave 5 formation from the high, and the breakthrough of the $29.05 TAPP. Normally, this would be a point at which I exit the trade, but a couple of things prevented this. First, I had set my initial exit for profit-taking higher than the $2.60 of the intraday. Secondly, greed had set-in by the time I saw the contract price reach $2.60, because I still believed DHI had a considerable move to come, so I moved the stop-loss point up to the trailing stop point of around $27.41, and left the profit-taking exit the same. If you haven’t used the trailing stop function in Profitsource, I would suggest you give it a try and see if it works for you. The only gripe I have is that you can’t pick a entry date from a mouse click. This forces you to enter the date in manually.

Just a side note: After realizing my undisciplined habit of greed, I immediately started watching one of my favorite recorded episodes of Deal or No Deal. I keep this around for just such an occasion. It reminds me of how easy it is to make a winning, sure-thing trade, into a big loser. Fortunately, this time, I was saved from my own stupidity even though the markets are not generous to the hard-headed.

On 02-01-07, I exited half the position for a credit of $2.40 or $240.00 per contract, and will the let the rest of it ride as long as it doesn’t go much below the $2.00 or $200.00 range or becomes to close to expiration. At this point, the initial investment has doubled, and the open-half is essentially a free trade. As you can see, the Wave 5 formation has moved up as well.

Continued in Final Stats

I will give the final stats later.

Later, Fibonacci

If you like the blog, visit the forum at www.Primalgreed.com Let's Network!

PLEASE REMEMBER THIS IS FOR EDUCATIONAL PURPOSES ONLY!Labels: Elliott Wave, Part 3, Profitsource, Wave 4 Buy |